Key Market Insights

§ The independent opinions of representatives from prominent companies corroborate the fact that the opportunities associated with digital therapeutics are rapidly rising and have enormous potential in the healthcare sector

§ Advances in the field of information technology have enabled the development of several digital therapeutic software solutions, which are capable of catering to the existing unmet needs in the healthcare domain

§ Considering the shear volume of players involved in developing these novel solutions and the ongoing pace of innovation in this field, digital therapeutic market is in an accelerated phase of growth

§ The relative strength (and eventual success) of a company is dependent on several factors, such as years of experience, size of its employee base, stage of fundraising and location of headquarters

§ Owing to the numerous benefits offered by digital therapeutics, the adoption of such solutions has increased in the recent past

§ With the growing interest in application of digital therapeutics, it is imperative that both new and existing brands identify ways to distinguish themselves from other industry stakeholders, in order to gain a competitive edge

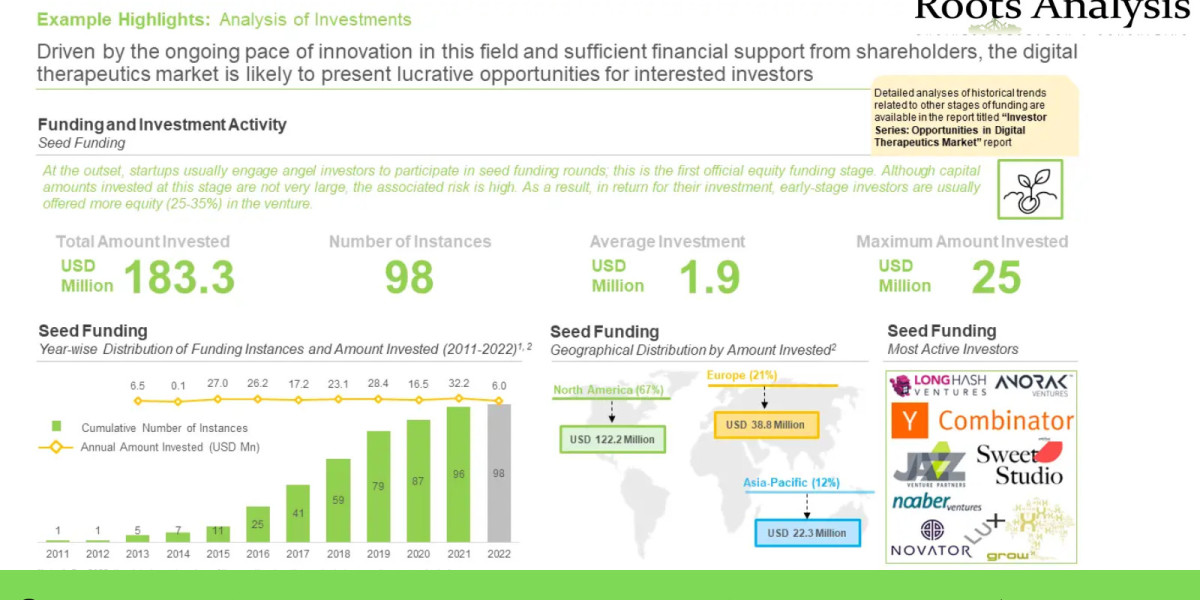

§ Over the last decade, owing to the opportunities associated with digital therapeutics, several industry and non-industry players have collectively invested USD 8.9 billion, across 445 funding instances

§ A significant proportion of the amount has been raised via venture capital investors, however, there are a few promising ventures that have already been publicly listed in various stock exchanges

§ Driven by the ongoing pace of innovation in this field and sufficient financial support from shareholders, the digital health market is likely to present lucrative opportunities for interested investors

§ Insights from an in-depth analysis of publicly disclosed financial statements, including product sales and earnings, offer the means to evaluate a company’s competitive position in the market

§ Financial ratios provide a deeper perspective onto a firm’s current and likely future capability to grow and thrive amidst the evolving competition in the industry

§ It offers insights to help investors identify and evaluate potential investment opportunities through a detailed analysis of recent trading activity, including price movement and volume

§ A variety of indicators have been used in order to scrutinize the supply and demand dynamics related to a security, which is believed to influence changes in price, volume and volatility of a stock

§ Akili Interactive is a US based digital therapeutics company working towards bringing together science and entertainment with great user experience, thereby revolutionizing medicine design and delivery

§ Digital therapeutic solution (public) ventures adopt varying strategies and continually monitor both internal and external risk parameters, in order to detect anomalies as early as possible

§ Given the cost saving potential of digital health solutions and growing interest of big pharma players, the digital therapeutics market is likely to grow at an accelerated pace

§ Investors that have entered the digital therapeutics market during the onset of the internet revolution, have reported multifold capital gains, resulting in a strong spur in investment activity in this domain

§ Based on strength and qualitative understanding of value offered, several companies have been shortlisted as potential acquisition targets for investors

Table of Contents

Excel Deliverables

EXCEL DELIVERABLE

1. INNOVATORS AND PRODUCTS DATASET

1.1. Analysis Notes

1.2. Innovator Landscape

1.3. Product Landscape

1.4. Value Proposition

1.5. Key Acquisition Targets

1.6. AI – AVII Appendices

2. FUNDING AND INVESTMENT ANALYSIS

2.1. Analysis Notes

2.2. Summary Dashboard

2.3. Capital Investments in Digital Therapeutics

2.4 AI – AIV Appendices

3. FUNDAMENTAL AND TECHNICAL FINANCIAL ANALYSIS

The information presented in this analysis is spread across separate MS Excel sheets, which provide information on key financial parameters and competitive insights based on historical and prevalent trends.

4. BUSINESS RISK ANALYSIS

4.1. Analysis Notes

4.2. Business Risk Data

4.3. AI – AVII Appendices

5. MARKET FORECAST AND OPPORTUNITY ANALYSIS

5.1. Analysis Notes

5.2. Market Forecast and Opportunity Analysis: Summary

5.3. Market Forecast and Opportunity Analysis: Base Scenario

5.4. Market Forecast and Opportunity Analysis: Conservative Scenario

5.5. Market Forecast and Opportunity Analysis: Optimistic Scenario

6. RETURN ON INVESTMENT

6.1. Analysis Notes

6.2. Estimated RoI for Investors in Company A

6.3. Estimated RoI for Investors in Company B

6.4. Estimated RoI for Investors in Company C

POWERPOINT DELIVERABLE

1 CONTEXT

2 PROJECT APPROACH

3 PROJECT OBJECTIVES

4 EXECUTIVE SUMMARY

Section I: Need for Digital Therapeutics and Innovators Landscape

5 THE DIGITAL THERAPEUTICS MARKET

5.1. Overview

5.2. Historical Milestones

5.3. Key Types of Solutions

5.4. Key Strategic Initiatives

5.5. Key Concepts, Marketed Products and Challenges

6. DIGITAL THERAPEUTICS: INNOVATOR LANDSCAPE

6.1. Methodology

6.2. Innovators in the Digital Therapeutics Market

6.3. Analysis of Competitive Landscape

6.4. Conclusion

7. DIGITAL THERAPEUTICS: PRODUCT LANDSCAPE AND COMPANY HEALTH INDEXING

7.1. List of Digital Therapeutics

7.2. Analysis of Product Landscape

7.3. Health Indexing Methodology

7.4. Company Health Indexing

8. VALUE PROPOSITION ANALYSIS

8.1. Overview and Methodology

8.2. Outreach-related Value

8.3. Developer Value

8.4. Product-related Value

8.5. Value to Patients

8.6. Concluding Remarks

9. COMPANY COMPETITIVENESS ANALYSIS

9.1. Overview and Methodology

9.2. Company Competitiveness Analysis

Section II Analysis of Investments

10 FUNDING AND INVESTMENT ANALYSIS

10.1. Overview

10.2. Analysis by Type of Funding

10.3. Analysis by Geography and Most Active Players

10.4. Analysis of Trends Across Various Funding Categories

10.5. Summary of Funding and Investments

Section III Financial Analysis and Assessment of Business Risks

11 FINANCIAL ANALYSIS OF PUBLIC VENTURES

11.1. Fundamental Financial Analysis Overview

11.2. Financial Ratios (Interpretation Guide)

11.3. Case Study 1